Scope of Refund of Unutilized ITC

GST Refunds 2024 -Unutilized Input Tax Credit :

Introduction to the concept and its scope

One of the Major Categories for refund may arise would be on account of Unutilized ITC

Section 54 permits the refund of Unutilized Input Tax Credit (ITC) in only two situations

- Zero Rated Supply Without payment of IGST (Refund of Inputs and Input Services is admissible)

- Inverted Duty Structure (Refund of Inputs is admissible)

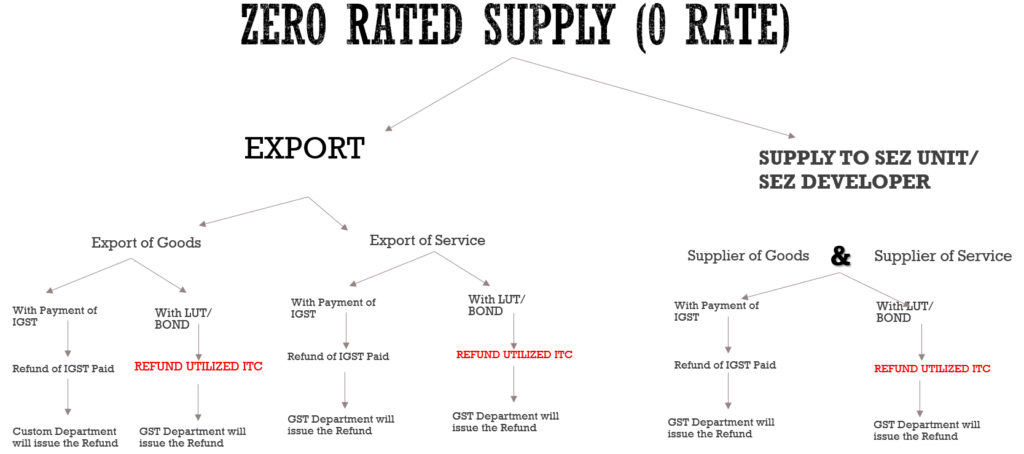

Zero Rated Supply (Section 16(1) IGST Act)

Explanation of zero-rated supplies under Section 16(1) of the IGST Act

Zero Rated Supply means any of the following supplies of goods or services or both namely

- Export of Goods or Services or Both

- Supply of Goods or Services or Both to a SEZ Unit or SEZ Developer

In Order to Zero Rate the Supply Chain law intend to make the Zero-Rated Supply is tax free, i.e. There is no burden of tax either on the Input Side or on Output Side.

All exports (Goods & Services) as well as supplies to SEZ Units or developers have been categorized as Zero Rated Supplies (Section 16 IGST Act)

Export of Goods (Section 2(5) of IGST Act)

Taking goods out of India to a place Outside India

Export of Service(Section 2(6) of IGST Act

For Qualifying the definition of of Export of Service following 5 Conditions shall be satisfied.

- Supplier is located In India

- Recipient is located outside India

- Place of Supply is outside India

- Payment has been received in Forex or in Indian Rupees, if permitted

- Supplier & Recipient are not merely establishment of a Distinct Person

Special Economic Zone (SEZ) is a specifically delineated duty-free enclave and shall be deemed to be Foreign territory for the purposes of trade operations, duties and tariffs.

To make things clearer, please take a look at the diagram below

Inverted Duty Structure

Understanding inverted duty structure and its implications

Section 54(3) of the CGST Act laid down two Conditions

- Rate of Tax on Inputs is higher AND

- Rate of Tax on Output Supplies (Goods & Services) IS LOWER

To determine Inverted Duty Structure Rate of Tax on Input Services & Capital Goods are not relevant.

Time Limit (Section 54)

Explanation of the time limit for claiming refunds under Section 54

A refund claim needs to be filed within two years from relevant date. A refund of unutilized input tax credit can be claimed at the end of any tax period

Relevant Date (Explanation to Section 54)

Explanation of the relevant date for refund calculation as per the explanation to Section 54

Export of Goods

- If Goods are Exported by Ship/ Aircraft – Date on Which Ship/ Aircraft leaves India will be treated as Relevant Date

- If Goods are Exported by Land – Date on which Goods pass the Custom Frontier will be treated as Relevant Date

- If Goods are Exported by POST – Date of dispatch of Goods by the Post Office will be treated as Relevant Date

Export of Services

- Payment realized after Supply THEN Date of receipt of Payment will be treated as Relevant Date

- PAYMENT RECEIVED IN ADVANCE THEN Date of Issue of Invoice will be treated as Relevant Date

Supply to SEZ Unit/ SEZ Developer

Due date for Furnishing of Return under Section 39 in respect of Such Supplies

Inverted Duty Structure

The due date for furnishing of return under Section 39 for the period in which such claim for refund arises

Threshold Limit

Discussion on the threshold limits for refund claims

Minimum Threshold Limit – The Amount of Refund Should not be less than 1000 INR

Maximum Threshold Limit – Not Applicable

Refund Procedure/ Forms Requirement (Rule 89 of CGST Rules)

Detailed procedure for filing refund claims and required forms as per Rule 89 of the CGST Rules

Applicant shall file Refund Application online in the Form of GST RFD-01

The electronic credit ledger shall be debited by an amount equal to the refund so claimed

Once Application is filed by the Applicant then Application to be forwarded to Proper Officer for scrutinize for the completeness

If PO found the Application Complete in All respect then Refund Acknowledgement i.e. GST RFD-02 clearly indicating date of filing of Claim shall be issued within 15 days of Refund Application and will be taken up for the Final Processing

If PO found any deficiencies in Refund Application Then PO will Issue Deficiency Memo within 15 days i.e. GST RFD-03

(The person applying needs to submit a new refund application then E Credit Ledger which was debited at the time of Refund Application filed should be Recredited to the Applicant)

(The time period, from the date of filing of the refund claim in FORM GST RFD-01 till the date of communication of the deficiencies in FORMGST RFD-03 by the proper officer shall be excluded from the period of two years as specified in respect of any such fresh refund claim filed by the applicant after rectification of the deficiencies)

Withdrawal of Refund Application

Conditions and procedures for withdrawing a refund application

After the submission of the Refund Application If any of the below mentioned action has not been taken by the officer, then Refund application can be withdrawn by the Applicant by filing GST RFD-01W

- Provisional refund sanction order in FORM GST RFD-04

- Final refund sanction order in FORM GST RFD-06

- Payment order in FORM GST RFD-05

- Refund withhold order in FORM GST RFD-07

On submission of application for withdrawal of refund in FORM GST RFD-01W , any amount debited at the time of filing Refund Application from electronic credit ledger shall be credited back to the E Credit ledger.

Grant of Provisional Refund

Provisional refund provisions, conditions, and process

The proper officer after scrutiny of the claim and the evidence submitted in support thereof and on being prima facie satisfied that the amount claimed as refund shall make an order in FORM GST RFD-04, Sanctioning the amount of refund on a provisional basis within seven days from the date of the acknowledgement i.e. GST RFD-02

The order issued in FORM GST RFD-04 shall not be required to be revalidated by the proper officer

The proper officer shall issue a payment order in FORM GST RFD-05 for the amount sanctioned and the same shall be electronically credited to any of the bank accounts of the applicant mentioned in his registration particulars and as specified in the application for refund on the basis of a consolidated payment advice.

Payment order in FORM GST RFD-05 shall be required to be revalidated where the refund has not been disbursed within the same financial year in which the said payment order was issued.

Exception for Provisional Refund

Person Supplies ZERO Rated Should not be prosecuted for Any Offense under GST law/ an existing law with tax evasion charge of greater than 250 lakhs in last 5 years immediately preceding the Tax period for which refund is claimed

Proper Officer has to rely on declaration being filed by the Applicant that the Applicant has not prosecuted for Any Offense under GST law/ and existing law with tax evasion charge of greater than 250 lakhs in last 5 years immediately preceding the Tax period for which refund is claimed

For Example –

Upon filing a refund application for zero-rated supplies, refund amounted of Rs. 100,000, a provisional refund order was issued, granting 90% of the claimed amount, equating to Rs. 90,000, based on the applicant’s initial eligibility assessment.

Subsequently, upon thorough examination during the final processing of the application, the proper officer determined that the applicant is eligible for only Rs. 60,000 instead of the initially claimed Rs. 100,000.

Consequently, the proper officer will issue a Show Cause Notice in form GST RFD-08, prompting the applicant to provide justification regarding the following:

- Explanation as to why the claimed amount of Rs. 40,000 should not be rejected in accordance with the relevant provisions of the law.

- Justification as to why the erroneously refunded amount of Rs. 30,000 should not be recovered under Section 73/74, along with associated interest and penalty charges.

Documentation Requirements

List and explanation of documentation required for refund claims

The Refund application shall be accompanied by documentary evidences in Annexure 1 in FORM GST RFD-01 to establish that a refund is due to the applicant

Export of Goods – A statement containing the number and date of shipping bills or bills of export and the number and the date of the relevant export invoices

Export of Services – A statement containing the number and date of invoices and the relevant Bank Realisation Certificates or Foreign Inward Remittance Certificates

(As Realization of Sale Proceed is mandatory in case of Export of Services to qualify the definition of Export of Services in Section 2(6) of IGST Act)

Supply of Goods to SEZ Unit/ SEZ Developer – A statement containing the number and date of invoices along with the evidence regarding the Endorsement by Specified Officer

AdditionallyA declaration to the effect that tax has not been collected from the SEZ Unit or SEZ Developer

Supply of Services to SEZ Unit/ SEZ Developer – A statement containing the number and date of invoices, the evidence regarding the Endorsement by Specified Officer and the details of payment, along with the proof thereof made by the recipient to the Supplier

AdditionallyA declaration to the effect that tax has not been collected from the SEZ Unit or SEZ Developer

Endorsement by Specified officer

Supplier of goods – Endorsement That Such goods have been admitted in full in the Special Economic Zone for authorized operations as endorsed by the specified officer appointed in the Zone

Supplier of services – Endorsement That Receipt of services for authorised operations as endorsed by the specified officer appointed in the Zone

Specified officer means a “Specified Officer” or an “Authorised officer” as defined under rule 2 of the Special Economic Zone Rules, 2006

As per Rule 46 The invoice shall carry an endorsement

“SUPPLY MEANT FOR EXPORT/SUPPLY TO SEZ UNIT OR SEZ DEVELOPER FOR AUTHORISED OPERATIONS UNDER BOND OR LETTER OF UNDERTAKING WITHOUT PAYMENT OF INTEGRATED TAX”

Inverted Duty Structure – A statement containing the number and the date of the invoices received and issued during a tax period.

Refund Calculation for Zero Rated Supply

Methodology for calculating refunds on zero-rated supplies

In the case of zero-rated supply of Goods or Services or both Only Proportionate Refund of Inputs and Input Services (ITC on Capital Goods is not eligible to Refund in case of Zero Rated Supply) shall be granted as per the following formula

Refund Amount =

Net ITC x (Turnover of zero-rated supply of goods + Turnover of zero-rated supply of services)

Adjusted Total Turnover

Net ITC – means input tax credit availed oninputs and input services during the relevant period But Excludes ITC availed for which refund is claimed under sub-rules (4A) or (4B) or both;

Turnover of zero-rated supply of goods means lower of the two

- The value of zero-rated supply of goods made during the relevant period without payment of tax under bond or letter of undertaking

- The value which is 1.5 times the value of like goods domestically supplied by the same or, similarly placed, supplier, as declared by the supplier

(Turnover of supplies in respect of which refund is claimed under sub-rules (4A) or (4B) or both shall not be considered)

Turnover of zero-rated supply of services

The aggregate of the payments received during the relevant period for zero-rated supply of services AND

Zero-rated supply of services where supply has been completed for which payment had been received in advance in any period prior to the relevant period LESS

Advances received for zero-rated supply of services for which the supply of services has not been completed during the relevant period;

Adjusted Total Turnover means the sum total of the value of-

The turnover in a State or a Union territory, as defined under clause (112) of section 2, excluding the turnover of services; and

The turnover of zero-rated supply of services determined in terms of clause (D) above and non-zero-rated supply of services,

excluding-

(i) the value of exempt supplies other than zero-rated supplies; and

(ii) the turnover of supplies in respect of which refund is claimed under sub-rule (4A) or sub-rule (4B) or both, if any, during the relevant period.]

Relevant period means the period for which the claim has been filed.

Note – The value of goods exported from India will be determined by either the Free on Board (FOB) value mentioned in the Shipping Bill or the value stated in the tax invoice, whichever is lower

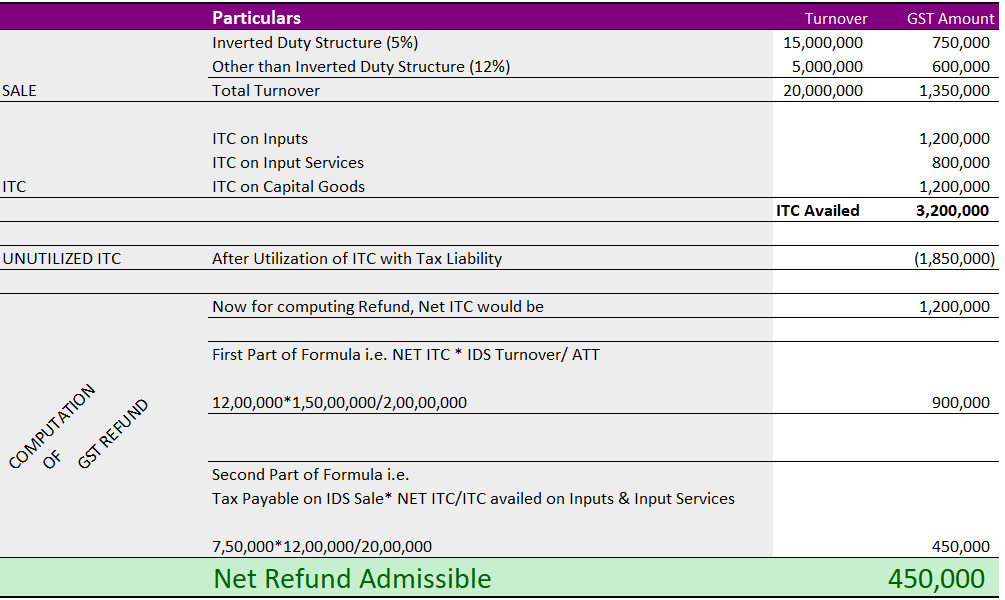

Refund Calculation for Inverted Duty Structure

Methodology for calculating refunds under the inverted duty structure

Inverted Duty Structure (Rule 89(5) of CGST Rules)

In the case of Inverted Duty Structure of Goods or Services or both Only Proportionate Refund of Inputs (ITC on Input Service and Capital Goods is not eligible to Refund in case of Inverted Duty Structure) shall be granted as per the following formula

In the case of refund on account of inverted duty structure, refund of input tax credit shall be granted as per the following formula:-

Maximum Refund Amount = {(Turnover of inverted rated supply of goods and services) x Net ITC /Adjusted Total Turnover} – 12[{tax payable on such inverted rated supply of goods and services x (Net ITC ÷ ITC availed on inputs and input services)}].

Explanation: – For the purposes of this sub-rule, the expressions –

Net ITC shall mean input tax credit availed on inputs during the relevant period other than the input tax credit availed for which refund is claimed under sub-rules (4A) or (4B) or both

Adjusted Total Turnover means the sum total of the value of-

The turnover in a State or a Union territory, as defined under clause (112) of section 2, excluding the turnover of services; and

The turnover of zero-rated supply of services determined in terms of clause (D) above and non-zero-rated supply of services,

excluding-

(i) the value of exempt supplies other than zero-rated supplies; and

(ii) the turnover of supplies in respect of which refund is claimed under sub-rule (4A) or sub-rule (4B) or both, if any, during the relevant period.]

Relevant period means the period for which the claim has been filed.

Doctrine of Unjust Enrichment

Explanation of the doctrine and its relevance to refund claims

Doctrine of Unjust Enrichment – No person can be allowed to enrich inequitably at the expense of another

Talking about Unjust enrichment, a presumption is always drawn that the businessman may have shifted the incidence of tax to the final consumer. This is because GST is an indirect tax whose incidence is to be borne by the consumer.

It is for this reason that every claim of refund except few cases needs to pass the test of unjust enrichment. And every such claim if sanctioned is first transferred to the Consumer Welfare Fund.

Exceptions where Test of Unjust Enrichment does not apply

- Accumulated ITC

- Refund on account of exports

- Refund of payment of tax which was paid in Wrong head

- Refund of tax paid on a supply which is not provided or which refund voucher is issued or if the applicant shows that he has not passed on the incidence of tax to any other person

In all other cases the test of unjust enrichment needs to be satisfied for the claim to be paid to the applicant.

Thus In case of Refund of Unutilized ITC No need to file any Self Declaration or Declaration from CA(Chartered Accounant or Cost Accountant) along with Refund Application to prove that the Burden of Tax is not passed on.

Adjustment of GST Refund

Provisions for adjustment of refund amounts

Where any refund is due to a registered person who has defaulted in furnishing any return or where there is confirmed Demand of any TAX, Interest & Penalty Against Registered Person and That Demand has not been stayed by any court, Tribunal or Appellate Authority by the specified date(Last date for filing an appeal) The proper officer may Adjust/ deduct GST Refund against GST Dues or Dues under Existing Law (Section 54(10) of CGST Act)

GST Dues can be adjusted against GST Refund Where any amount payable by any person under CGST Act/ Rules is not paid, Then Proper Officer may deduct such amount from ANY MONEY OWING TO SUCH PERSON (Section 79 of CGST Act)

Dues under Existing laws can be adjusted against GST Refund Recovery of any tax, Interest, fine, Penalty or any other amount recoverable under the existing law (Excise, Service Tax & VAT) as an arrear of tax under GST (Section 142 of CGST Act)

SECTION 79 & SECTION 142 ARE MORE WIDER THAN SECTION 54(10) applicability

Withholding of GST Refund

Circumstances under which refunds may be withheld

Withholding By Proper Officer

Where any refund is due to a registered person who has defaulted in furnishing any return or where there is confirmed Demand of any TAX, Interest & Penalty Against Registered Person and That Demand has not been stayed by any court, Tribunal or Appellate Authority by the specified date(Last date for filing an appeal) The proper officer may Withhold GST Refund by issuing Order for Withholding Refund in GST RFD-07 PART A

Release of Refund Withhold – Where Proper Officer is satisfied that Registered Person has furnished the Return AND pay the GST Dues, Hence Refund is no longer liable to be withheld he may pass an order for release of withheld refund in Part B of FORM GST RFD- 07

Withholding By Commissioner

If there’s an order for a refund that’s under appeal or Department is considering challenging the Refund Order in Appeal or there are ongoing proceedings related to it or , and if the Commissioner believes that granting the refund could harm the revenue due to fraud or misconduct, they can Withhold and Issue Order for Withholding Refund in GST RFD-07 Part A

Where a refund is withheld by Commissioner then If Refund arise as a result of the Appeal of further proceeding to the Applicant, Then In any case Interest shall not be paid to the applicant more than 6%

Period of Withholding – As decided by the Commissioner

Release of Refund Withhold – Where Commissioner is satisfied that the refund is no longer liable to be withheld he may pass an order for release of withheld refund in Part B of FORM GST RFD- 07

Where an order giving rise to a refund is the subject matter of an appeal or further proceedings or where any other proceedings under this Act is pending and the Commissioner is of the opinion that grant of such refund is likely to adversely affect the revenue in the said appeal or other proceedings on account of malfeasance or fraud committed, he may, after giving the taxable person an opportunity of being heard, withhold the refund till such time as he may determine.

Approval/ Rejection of GST Refund

Process and criteria for approving or rejecting refund claims

DUE & PAYABLE TO APPLICANT

Where The proper officer is satisfied that a refund is due and payable to the applicant , he shall make an order in FORM GST RFD-06 sanctioning the amount of refund LESS The amount of Provisionally Refunded, if any LESS The amount Adjusted against his outstanding demand, if any.

Proper Officer will issue a payment order in FORM GST RFD-05 for the amount of refund and the same shall be electronically credited to any of the bank accounts of the applicant mentioned in his registration particulars and as specified in the application for refund on the basis of a consolidated payment advice

Payment order in FORM GST RFD-05 shall be required to be revalidated where the refund has not been disbursed within the same financial year in which the said payment order was issued.

DUE BUT NOT TO THE APPLICANT

Where the proper officer is satisfied that the amount is refundable but not to the Applicant Then he shall make an order in FORM GST RFD-06 and issue a payment order in FORM GST RFD-05 , for the amount of refund to be credited to the Consumer Welfare Fund.

Not Due at All

Where the proper officer is satisfied that the whole or any part of the amount claimed as refund is not admissible or is not payable to the applicant, he shall issue a Notice in FORM GST RFD-08 to the applicant, requiring him to furnish a reply in FORM GST RFD-09 within a period of fifteen days of the receipt of such notice and after considering the reply, make an Sanctioning Order/ Rejecting Order in FORM GST RFD-06

(Rejection Order will be Issued Only After giving Opportunity of being heard)

Refund shall be credited to the bank account of the Applicant within 60 days of Refund Application, Else Interest @ 18% p.a shall be paid)

If Rejection Order issued in GST RFD-06 then E Credit Ledger which was debited at the time of Refund Application filed shall be Recredited to the Applicant)

Interest on refunds will begin accruing the day after 60 days from when the refund application is received until the refund amount is deposited into the applicant’s bank account. To ensure timely processing, tax authorities are urged to issue the final sanction order and payment order within 45 days of the Application Reference Number (ARN) generation, so that the refund is completed within 60 days

(CBIC Circular No. 125/44/2019-GST)

Remedy After Rejection of Refund

Rejection Order is an Appealable Order

Rejection Order of Refund claim is an appealable order Under Section 107 of the CGST Act, 2017. The Person aggrieved by the decision or Order of the adjudicating authority may appeal to the Appellate Authority with in 3 Months (6 Months by the department) from the date on which the said decision or order is communicated to such Person.

Compliance with Natural Justice

Importance of natural justice in refund proceedings

In case the claim is sought to be rejected by the proper officer, a notice has to be given online to the applicant stating the ground on which the refund is sought to be rejected. The applicant needs to respond online within 15 days from the receipt of such notice. Thus no claim can be rejected without putting the applicant to notice.

Disbursement of GST Refund

Process and timelines for refund disbursement

The refund claim, wherever due, will be directly credited to the bank account of the applicant. The applicant need not come to the authorities to collect the cheques or for any other issues relating to the refund claim.

Consolidated Payment Advice is issued by Common Portal Then Disbursement is made by PFMS (Public Financial Management System (Rule 91 CGST Rules)

If Disbursement is not done in same Financial year then Payment Order i.e. GST RFD-05 needs to be Revalidated (Rule 91 CGST Rules)

Interest on Delayed Refund

Calculation and provisions related to interest on delayed refunds

GST Refund Credited to bank account beyond 60 Days

If any Tax ordered to be refunded is not refunded within 60days from the date of receipt of application for refund claim Then interest at such rate not exceeding 6% shall be payable to the applicant

(Interest shall be calculated From the Date of Expiry of 60 days from the ARN (Application Reference Number) of Refund Application filed TO the Date of Actual Credit into Bank)

GST Refund arise from an Order passed by an Adjudicating Authority or Appellate Authority

In case of refund arises from an order passed by an adjudicating authority or Appellate Authority or Appellate Tribunal or court which has attained finality and the same is not refunded within sixty days from the date of receipt of application filed consequent to such order, Interest shall be paid by Rate not exceeding 9% p.a (Notification No. 13/2017 CT)

Now Applicant shall file a fresh application (125/244/2019-GST)

Relevant Date – 2 Years from DATE OF COMMUNICATION OF JUDGEMENT/ ORDER

Interest shall be paid by Rate not exceeding 9% p.a (Notification No. 13/2017 CT)

For any further queries or assistance regarding the GST Refund, feel free to contact us at [Taxationteam@gmail.com] We’re here to help!