(Applicable from 01/01/2024 to 30/03/2024)

- The Haryana One Time Settlement Scheme 2023 :

- Introduction to Haryana One Time Settlement Scheme 2023

- Overview of Settlement Amounts

- Explanation of Terms

- Option to Pay in Installments

- Application Process

- Relevant Act covered under Haryana One Time Settlement Scheme 2023

- Treasury Head Under Haryana One Time Settlement Scheme 2023

- Criteria for Ineligibility under Haryana One Time Settlement Scheme 2023

- Recovery Initiated via Form DRC-07A

- Pending Appeals

- Verification & Time Limt

- Rejection Order (Form OTS-5)

- Key Points to Note

- Reference

- Conclusion

The Haryana One Time Settlement Scheme 2023 :

Introduction to Haryana One Time Settlement Scheme 2023

Starting from January 1st, 2024, for a period of 90 days, the Haryana government is implementing “The Haryana One Time Settlement Scheme for Recovery of Outstanding Dues, 2023” to assist in recovering overdue payments. This scheme operates under the Haryana Settlement of Outstanding Dues Act, 2017, and comes with specific conditions and limitations.

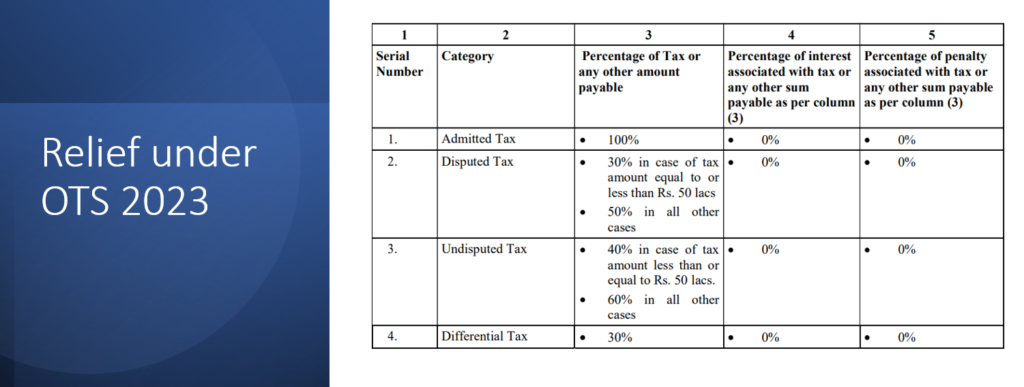

Overview of Settlement Amounts

The Haryana One Time Settlement Scheme for Recovery of Outstanding Dues, 2023, offers taxpayers the opportunity to settle their outstanding dues through predefined percentages based on different categories. These categories include admitted tax, disputed tax, undisputed tax, and differential tax. Here’s a breakdown of the settlement amounts:

- Admitted Tax: Taxpayers are required to pay 100% of the admitted tax amount, with no additional interest or penalty.

- Disputed Tax: For disputed tax amounts equal to or less than Rs. 50 lakhs, taxpayers need to pay 30% of the tax amount. For amounts exceeding Rs. 50 lakhs, the payment percentage increases to 50%. No interest or penalty is levied in this category.

- Undisputed Tax: Tax amounts less than or equal to Rs. 50 lakhs require a payment of 40%, while amounts exceeding this threshold necessitate a payment of 60%. No interest or penalty is applicable here as well.

- Differential Tax: Taxpayers are required to pay 30% of the differential tax amount with no interest or penalty.

Explanation of Terms

- Admitted Tax: This refers to the tax amount that a taxpayer acknowledges and agrees to be due as per their records and assessments. It is the amount that the taxpayer admits to owing to the tax authorities.

- Disputed Tax: Disputed tax refers to the tax amount that is contested or disputed by the taxpayer. It is the amount that the taxpayer disagrees with or contests regarding its accuracy or legitimacy.

- Undisputed Tax: Undisputed tax is the portion of the tax liability that both the taxpayer and the tax authorities agree upon and do not contest.

- Differential Tax: Differential tax represents the difference between the tax amount calculated by the taxpayer and the tax amount determined by the tax authorities. It arises when there is a variance in the tax calculations between the taxpayer and the authorities.

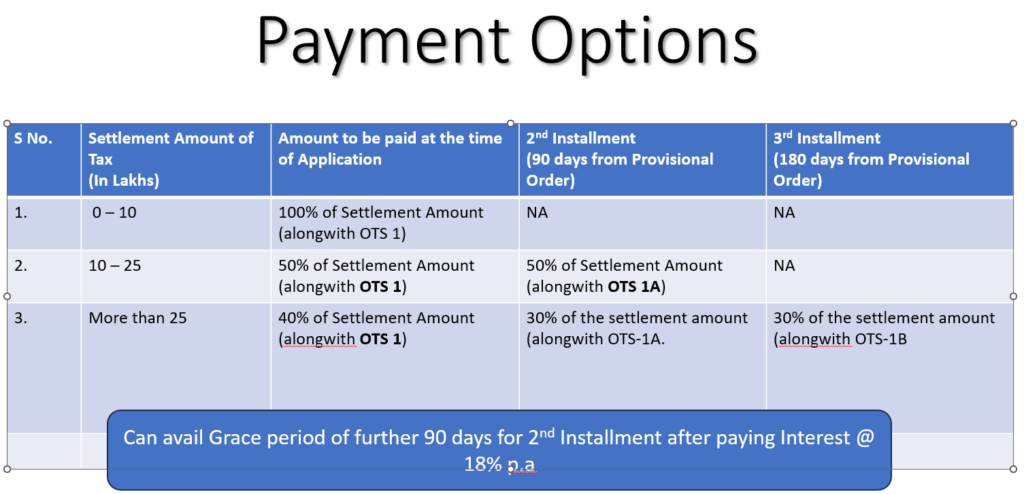

Option to Pay in Installments

This Scheme provides taxpayers with the flexibility to pay their settlement amounts in installments, based on the total amount of tax owed. Here’s a breakdown of the installment options available under the Haryana One Time Settlement Scheme for Recovery of Outstanding Dues, 2023:

- Upto 10 Lakhs:

- Taxpayers with dues amounting up to 10 lakhs have the option of making a full and final settlement payment along with FORM OTS-1. No additional installments are required in this category.

- 10 Lakhs to 25 Lakhs:

- Taxpayers with dues ranging from 10 lakhs to 25 lakhs are required to pay 50% of the settlement amount along with FORM OTS-1 at the time of application.

- The remaining 50% of the settlement amount should be paid as the second installment, with intimation provided in FORM OTS-1 A.

- More than 25 Lakhs:

- Taxpayers with dues exceeding 25 lakhs are required to pay 40% of the settlement amount along with FORM OTS-1 at the time of application.

- The second installment, totaling 30% of the settlement amount, should be paid with intimation provided in FORM OTS-1A.

- The remaining 30% of the settlement amount constitutes the third installment, with intimation provided in FORM OTS-1B.

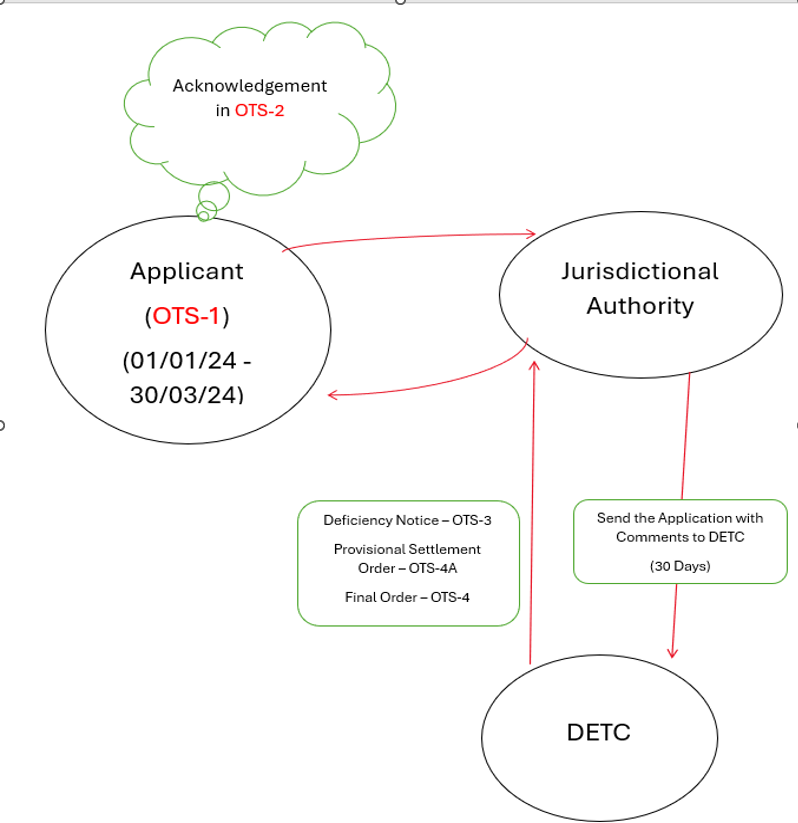

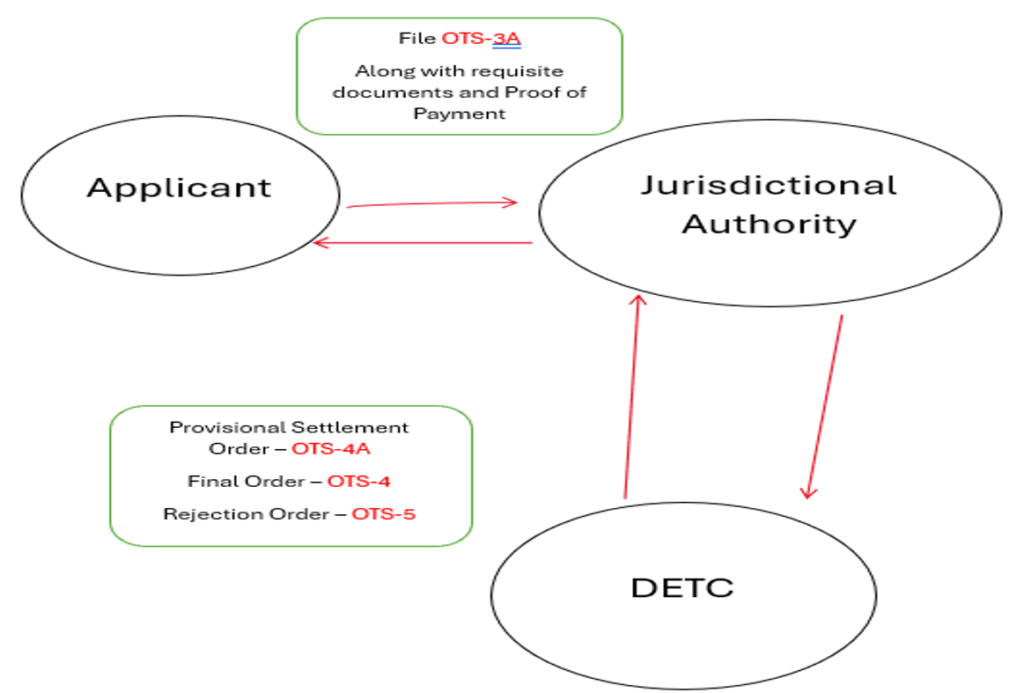

Application Process

The application process for the Haryana One Time Settlement Scheme for Recovery of Outstanding Dues, 2023, is designed to be straightforward and accessible to taxpayers. Below is a step-by-step guide outlining the process:

- Eligibility Check: Taxpayers should first ensure they meet the eligibility criteria specified under the scheme. This may include criteria related to the type and amount of outstanding dues, as well as any other conditions outlined by the authorities.

- Completion of Forms: Taxpayers are required to fill out the necessary application forms provided by the tax authorities. These forms typically include:

- FORM OTS-1: Application for settlement under the scheme.

- FORM OTS-1A: Intimation for the second installment (applicable for dues between 10 lakhs and 25 lakhs).

- FORM OTS-1B: Intimation for the third installment (applicable for dues exceeding 25 lakhs).

- Submission of Forms: Once the forms are completed, taxpayers should submit them along with the required documents to the designated tax authority office. The documents may include proof of outstanding dues, financial statements, and any other relevant records as specified by the authorities.

- Payment of Initial Installment: Depending on the total amount of outstanding dues, taxpayers are required to make the initial installment payment along with FORM OTS-1 at the time of application. The payment can be made through approved payment methods accepted by the tax authorities.

- Intimation of Subsequent Installments: For taxpayers with dues exceeding 10 lakhs, intimation for the second and third installments should be provided along with the respective forms (FORM OTS-1A and FORM OTS-1B) within the specified timelines.

- Completion of Installments: Taxpayers should ensure timely payment of the remaining installments as per the schedule outlined in Option to Pay in the scheme. Failure to adhere to the installment payment schedule may result in the invalidation of the settlement agreement.

- Acknowledgment and Settlement: Upon successful completion of the settlement process, taxpayers will receive acknowledgment from the tax authorities. The outstanding dues will be considered settled upon full payment of the agreed settlement amount.

Relevant Act covered under Haryana One Time Settlement Scheme 2023

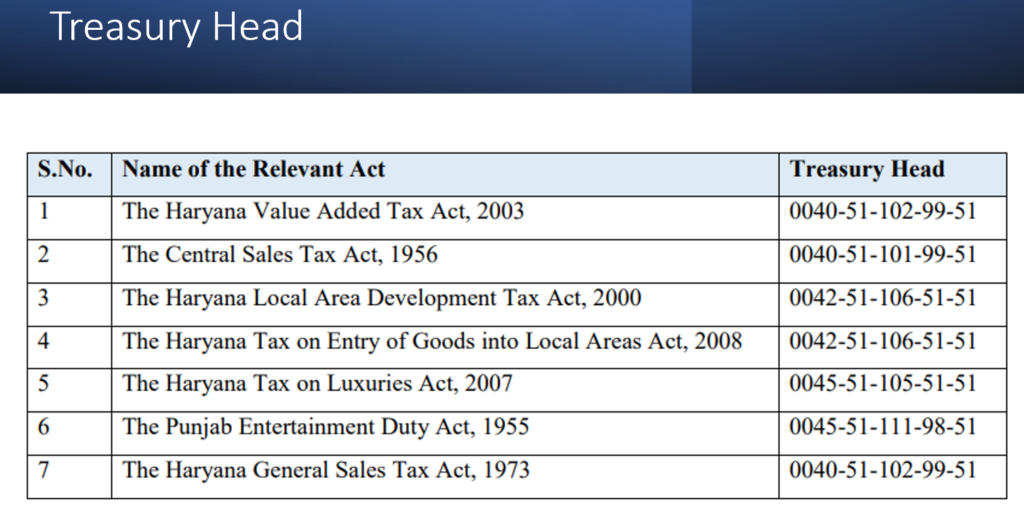

(i) The Haryana Value Added Tax Act, 2003 (6 of 2003);

(ii) The Central Sales Tax Act, 1956 (Central Act 74 of 1956) ;

(iii) The Haryana Local Area Development Tax Act, 2000 (13 of 2000);

(iv) The Haryana Tax on Entry of Goods in to Local Areas Act, 2008 (8 of 2008) ;

(v ) The Haryana Tax on Luxuries Act, 2007 (23 of 2007) ;

(vi) The Punjab Entertainment Duty Act, 1955 (Punjab Act 16 of 1955) ;

(vii) The Haryana General Sales Tax Act, 1973 (20 of 1973)

Treasury Head Under Haryana One Time Settlement Scheme 2023

Criteria for Ineligibility under Haryana One Time Settlement Scheme 2023

Applicants shall not be eligible to opt for the scheme in case,-

(a) criminal proceedings have been initiated against the applicant for any reason(s) under the relevant Acts;

(b) the demand relates to erroneous refund(s) under the relevant Act.

Recovery Initiated via Form DRC-07A

The applicants against whom the jurisdictional authority has initiated recovery proceedings by way of uploading FORM GST DRC-07A 2017 are also eligible to take benefit of the scheme. [Clause 7]

Pending Appeals

A person or assessee whose appeal is pending before the appellate authority under the Relevant Act, High Court, or Supreme Court can apply for the Scheme provided he shall withdraw the appeal fully and un-conditionally within 180 days from provisional order OTS 4A and submit the proof of such withdrawal of appeal before the jurisdictional authority. [Clause 6(h)]

(The order of Appellate Authority under the relevant act or order of High Court or Supreme Court regarding withdrawal of appeal by an applicant will be treated as a proof of withdrawal of appeal)

Verification & Time Limt

Rejection Order (Form OTS-5)

In the event of non-compliance with the Haryana One Time Settlement Scheme for Recovery of Outstanding Dues, 2023, a rejection order will be issued in the form of OTS-5. This rejection order may be issued for the following reasons:

- Failure to Pay 2nd Installment on Time: If the second installment isn’t paid even after the grace period, the application may be rejected.

- Non-payment of 3rd Installment within 180 Days: Not paying the third installment within 180 days of receiving the provisional order may lead to rejection.

- Withdrawal of Appeal Without Proof Submission: If you withdraw your appeal and fail to submit the required proof within 180 days, your application may be rejected.

- Missing Required Documents Listed in Deficiency Memo: If the documents specified in the deficiency memo aren’t submitted, your application might be rejected.

It’s crucial to adhere to the scheme’s requirements to avoid the issuance of a rejection order in the form of OTS-5.

Key Points to Note

Separate Assessment Year – Separate Application

Separate relevant Act – Separate Application

No appeal shall lie before any appellate authority under the relevant Act, High Court or Supreme Court against the final orders passed by the jurisdictional authority under this scheme.

No suit, prosecution or other legal proceeding shall lie against the Government or any official /officer of the Government for anything which is done or intended to be done in good faith, in pursuance of this scheme

No proceeding shall be commenced against any official /officer merely on the ground of subsequent detection of an error in calculating the amount of outstanding dues payable by the applicant, unless there is evidence of misconduct

Any amount of tax, interest or penalty or any other sum payable or paid before the appointed day shall not be refunded or adjusted under this scheme

The authority who has passed the final order under this scheme, may rectify any error which is apparent on the face of record in such order, either on his own motion or where such error is brought to his notice by the affected person within a period of 30 days from the date of issuance of such order

Any amount paid under this scheme shall neither be paid through Input tax nor shall be allowed to be claimed as Input tax by any person under the relevant Act or any other Act

The final order of settlement passed under this scheme with respect to the amount payable under this scheme shall be conclusive as to the matter and time stated

No Tax, Interest and Penalty

No Prosecution

All matters and time period covered by such order shall not be re-opened (Unless any material Particular furnished in the application is subsequently found to be false

Reference

The Haryana One Time Settlement Scheme for Recovery of Outstanding Dues, 2023, was issued under the authority of Haryana Government The official order or notification can be found on the this link

Conclusion

In conclusion, the Haryana One Time Settlement Scheme for Recovery of Outstanding Dues, 2023, offers taxpayers an opportunity to settle their overdue payments efficiently. Throughout this article, we’ve discussed the scheme’s provisions, eligibility criteria, application process, and potential rejection reasons.

It’s crucial for eligible taxpayers to adhere to the scheme’s requirements to benefit from its provisions and avoid penalties or rejection. By participating in the scheme, taxpayers can resolve their outstanding dues and contribute to smoother tax administration in the state.

We encourage eligible taxpayers to consider availing the benefits of this scheme and take proactive steps towards resolving any tax-related issues they may have. Should you require further information or assistance, we recommend reaching out to relevant authorities for guidance.

Thank you for your attention to this article. We hope it has provided valuable insights into the Haryana One Time Settlement Scheme, and we appreciate your interest in this important aspect of tax administration.

For any further queries or assistance regarding the Haryana One Time Settlement Scheme for Recovery of Outstanding Dues, feel free to contact us at [Taxationteam@gmail.com] We’re here to help!